The Comfort of FD: A Safe but Limited Growth Path

Imagine Vihaan, a 30-year-old IT professional. Every month, he diligently saves a portion of his salary and parks it in a Fixed Deposit (FD). It feels safe, like having a steady job—providing him a fixed return of 7-8% annually, just like a predictable paycheck.

Every year, when his FD matures, he gets a sense of accomplishment. A small but assured gain—a dopamine hit of financial security. But one day, as he watches the rising costs of housing, education, and healthcare, a thought strikes him: Will my FDs ever help me achieve true financial freedom?

The Illusion of Safety: Are You Really Growing?

Robert Kiyosaki, in his book Rich Dad, Poor Dad, highlights an important lesson. He says that if people are asked to learn something new that could help them earn 100 times more in the future, most would avoid it. Why? Because they are fixated on short-term results—“How much will I get in one year?”

Vihaan could relate to this. He had been playing it safe, focusing on short-term gains instead of long-term wealth creation. Then he came across a quote by Bill Gates that shook his perspective:

“People overestimate what they can do in one year and underestimate what they can achieve in ten years.”

He realized that true wealth isn’t about playing it safe; it’s about playing it smart.

The Power of Compounding: Let Money Work for You

Vihaan started exploring mutual funds and equity investments. Initially, he was skeptical—market fluctuations scared him. But then he understood the power of compounding.

He imagined planting a tree. In the first few years, it grows slowly, barely noticeable. But with time, its roots strengthen, and soon, it starts bearing fruits—year after year, effortlessly. Compounding works the same way. The earlier you start, the bigger the wealth you accumulate over time.

Real Wealth Creation: The Shift in Mindset

Here’s what Vihaan learned:

✅ Short-term gains are comforting, but long-term growth is transformational.

✅ Instead of locking money in low-yield FDs, let it grow with market-backed investments.

✅ Financial freedom comes from smart asset allocation, not just savings.

✅ Inflation eats into your FD returns, but investments can outpace inflation.

Vihaan didn’t stop his FDs completely—he kept them for emergency funds. But for wealth creation, he embraced SIPs, stocks, and other investment vehicles.

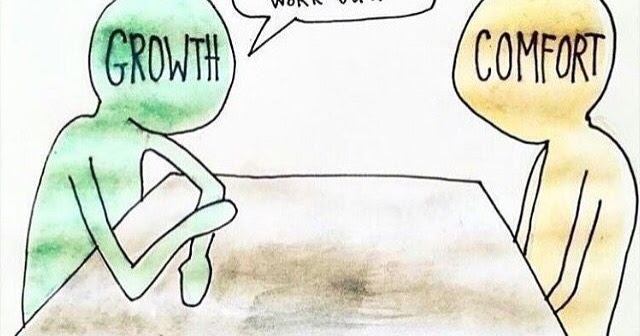

Your Choice: Stability or Growth?

Are you like Vihaan before his realization—playing it safe but limiting your financial growth? Or are you ready to think beyond the short term and embrace true wealth creation?

Start today, because time is the biggest asset in wealth-building. What will you choose—small, safe returns or the opportunity to create real wealth?

Join our WhatsApp Community for personal finance Related Content.

Join Now